NMG Provides Quarterly Update: Changing Market Dynamics and Intensified Commercial Negotiations Underpin Phase-2 Growth

New market dynamics set favorable conditions for Nouveau Monde Graphite as the Company maintains operational, commercial and financing focus on advancing its development to the final-investment-decision stage for its Phase-2 commercial facilities.

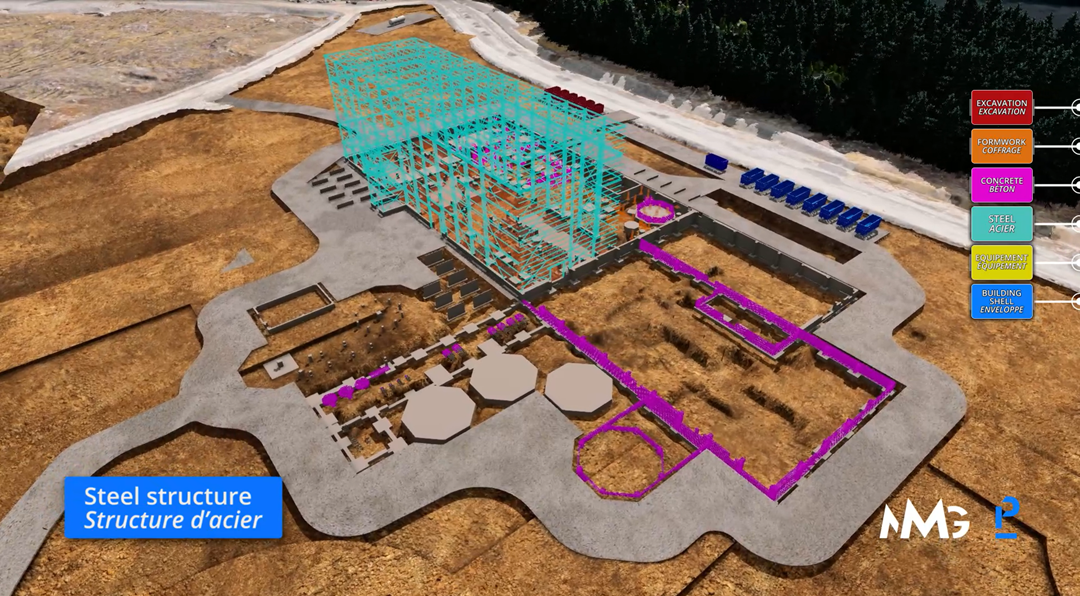

NMG Selects Pomerleau for Construction Management Preparation of its Phase-2 Facilities: Focus on Efficient, Cost-Optimized, and Safe Execution once FID is Reached

Nouveau Monde Graphite furthers its execution readiness for the construction of its Phase-2 commercial facilities, the Matawinie Mine and the Bécancour Battery Material Plant, with the appointment of Pomerleau as Construction Manager for the pre-construction stage.

NMG Advances Electrification Efforts: Confirmed Hydropower Supply and Progress on Collaboration with Caterpillar

Nouveau Monde Graphite reports advancement on its electrification program for the Phase-2 Matawinie Mine and Bécancour Battery Material Plant. Leveraging Québec’s clean power grid, NMG has confirmed electrical capacity and competitive rates, and defined zero-exhaust emission equipment deployment with Caterpillar.

NMG Pays Accrued Interests

Nouveau Monde Graphite announces the payment of accrued interests as part of a previously announced private placement.

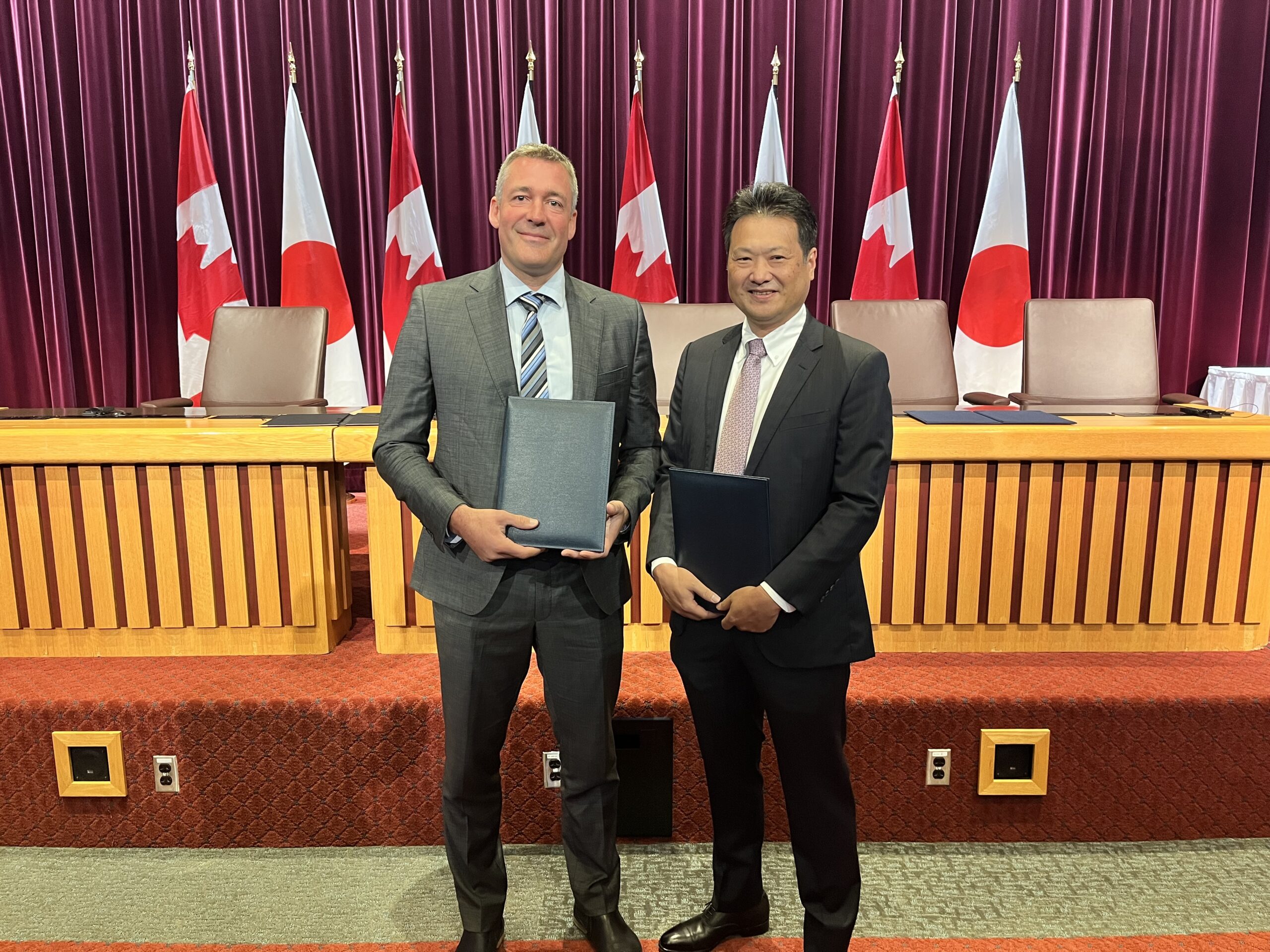

NMG and Panasonic Energy Announce Progress Update on Technological and Commercial Collaboration as Canada and Japan Reinforce Trade Relationship for a Low-Carbon Economy

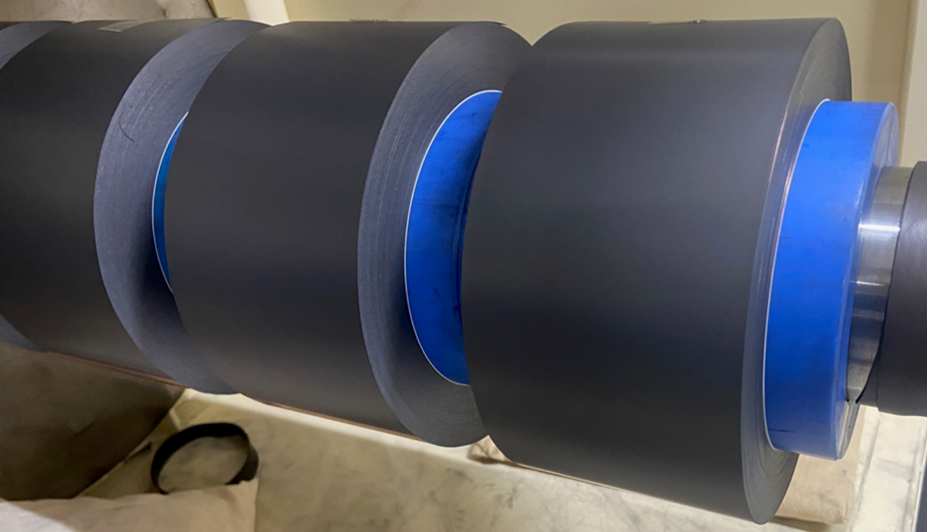

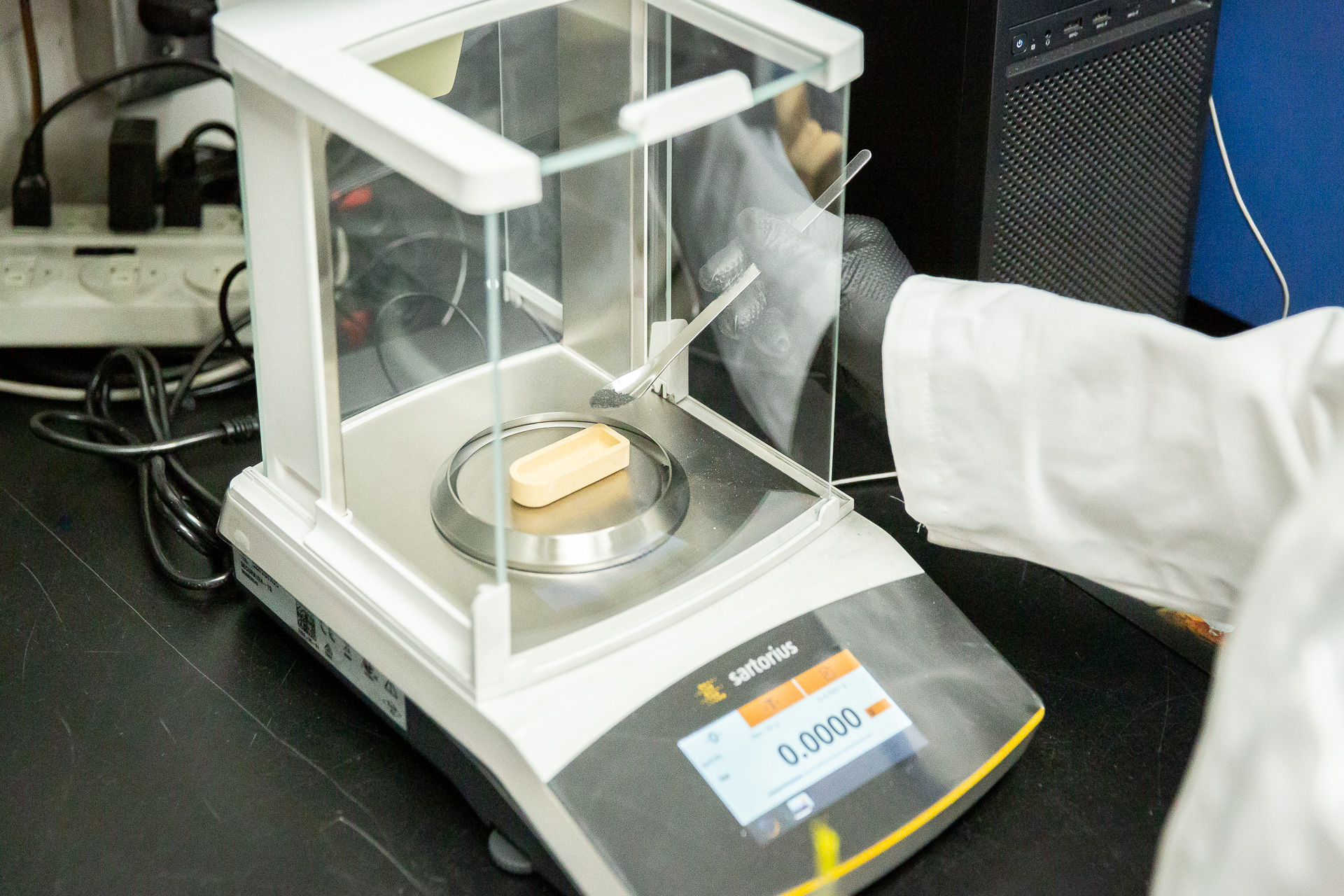

Nouveau Monde Graphite and Panasonic Energy diligently progress through their technological engagement and commercial discussions toward a definitive offtake agreement on the foundation of their framework agreement targeting NMG’s fully integrated ore-to-anode-material production.

NMG Provides a Quarterly Operational Update: Intense Commercial Engagement to Secure a Robust Foundation for Growth

Nouveau Monde Graphite reports advancement on the development of its fully integrated value chain, from ore to battery materials, set to become North America’s largest source of natural graphite.

NMG Pays Accrued Interests

Nouveau Monde Graphite announces today the payment of accrued interests as part of a previously announced private placement.

NMG Provides Commercial Update & Discloses Annual General and Special Meeting Voting Results

Nouveau Monde Graphite held today its virtual Annual General and Special Meeting of Shareholders. The Meeting was complemented with a corporate presentation by NMG’s management team providing shareholders with an update on the Company’s key projects, commercial engagement, and growth plan.