FROM ORE TO BATTERY MATERIALS

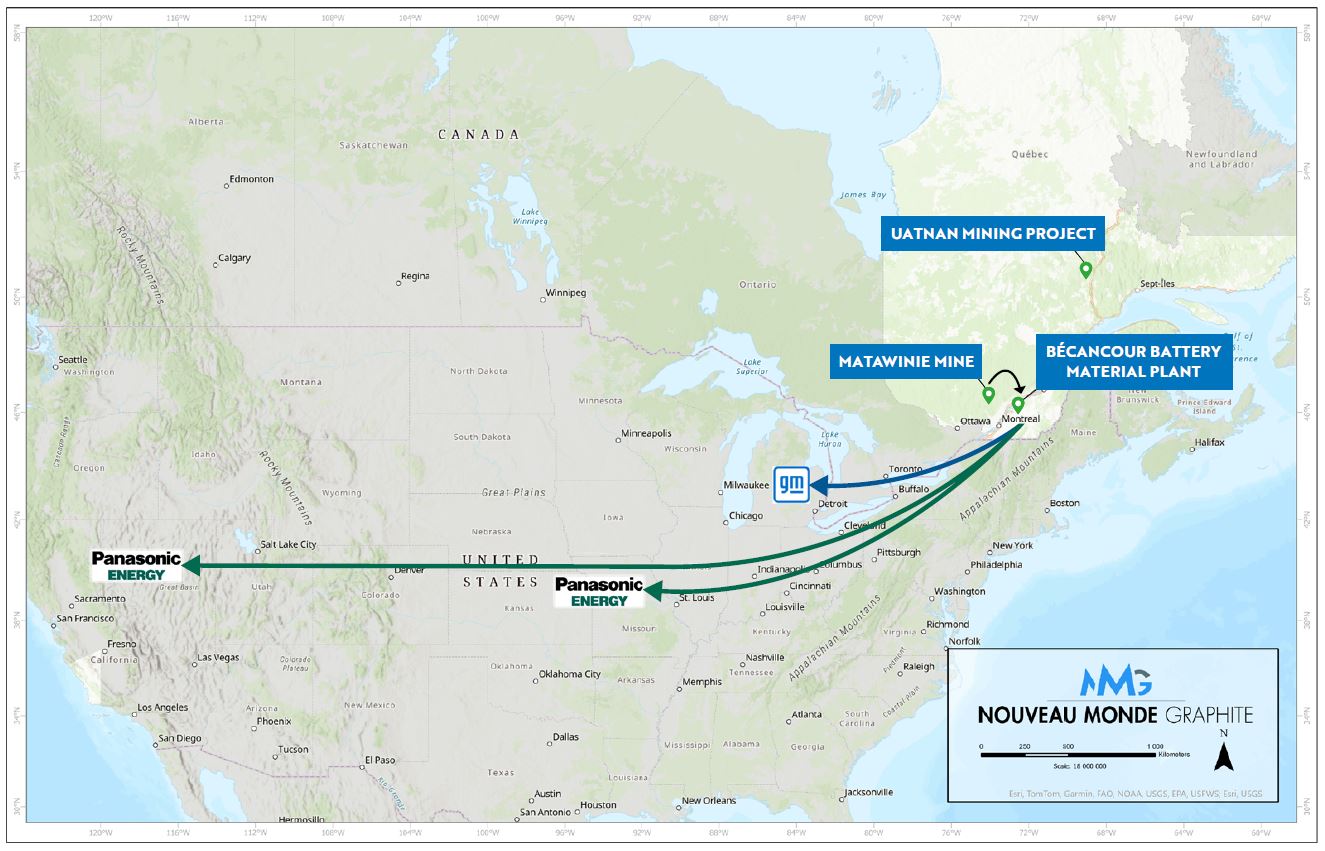

NMG is developing a turnkey natural graphite operation to supply the Western market with active anode material. Thanks to its abundant mineral resources and proprietary clean technologies, NMG is on track to become North America’s largest producer of natural graphite.

Matawinie

Mine and concentrator

Phase 1

In operation

Phase 2

Planned production of 103,000 tpa of graphite concentrate over 25 years

Bécancour

Battery materials plant

Phase 1

In operation

Phase 2

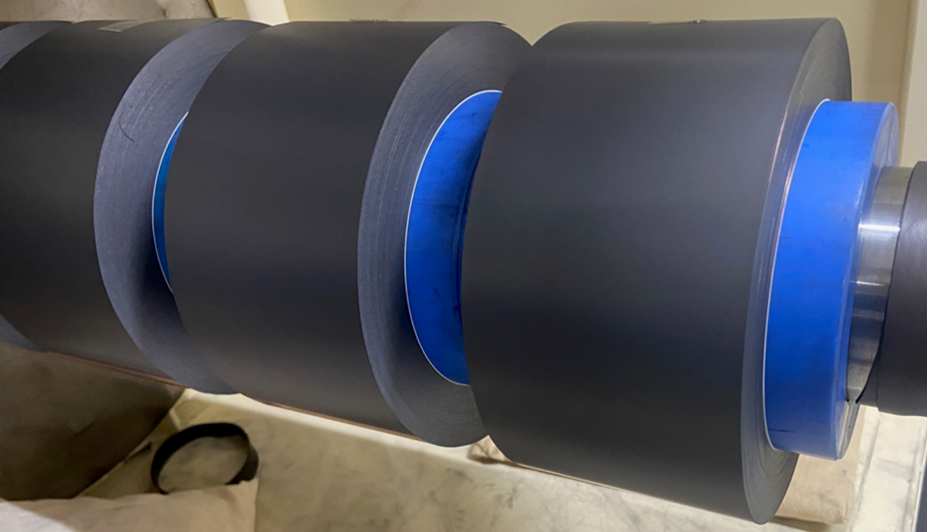

Planned production of 43,000 tpa of active anode material

Uatnan

Mine and concentrator

Mining project in development

Phase 3

Contemplated production of 500,000 tpa of graphite concentrate over 24 years

Thanks to our phased execution strategy, we ensure the responsible, low-risk development of our fully integrated value chain.

COMMERCIALIZATION IN DEVELOPMENT

Our Phase-2 integrated commercial operations includes the Matawinie Mine and the Bécancour Battery Materials Plant, both of which are within 150 km of Montréal, Québec.

Our 2022 Feasibility Study confirmed our project’s attractive economics thanks to robust operational parameters, a large mineral property, NMG’s proprietary technologies, full vertical integration, and clean hydroelectricity powering our operations.

61.7M

Tonnes of probable reserve at a 4.23% Cg average grade

1.16:1

Stripping ratio (LOM)

25 years

Life of mine (LOM)

103 ktpa

Annual graphite concentrate production (LOM)

43 ktpa

Annual production of active anode material

99.95% Cg

Purity of advanced materials

With its stringent sustainability standards, NMG is committed to making its mining equipment and ore concentration and processing equipment fully electric within the first five years of commercial production. This operating model, A WORLD’S FIRST FOR AN OPEN-PIT MINE, represents a potential reduction of over 300,000 tonnes of CO2 emissions over the mine’s lifespan.

We are diligently advancing our Phase 2 with detailed engineering, preparatory work, construction planning, and the procurement of equipment and services.

GROWTH IN PLANNING

NMG is actively planning its Phase 3 expansion to meet the growing demand from Western markets. The Uatnan Mining Project, also located in Québec, has demonstrated attractive potential for the production of around 500,000 tonnes of graphite concentrate per year, making it ONE OF THE WORLD’S LARGEST NATURAL GRAPHITE PROJECTS.

MATAWINIE MINE

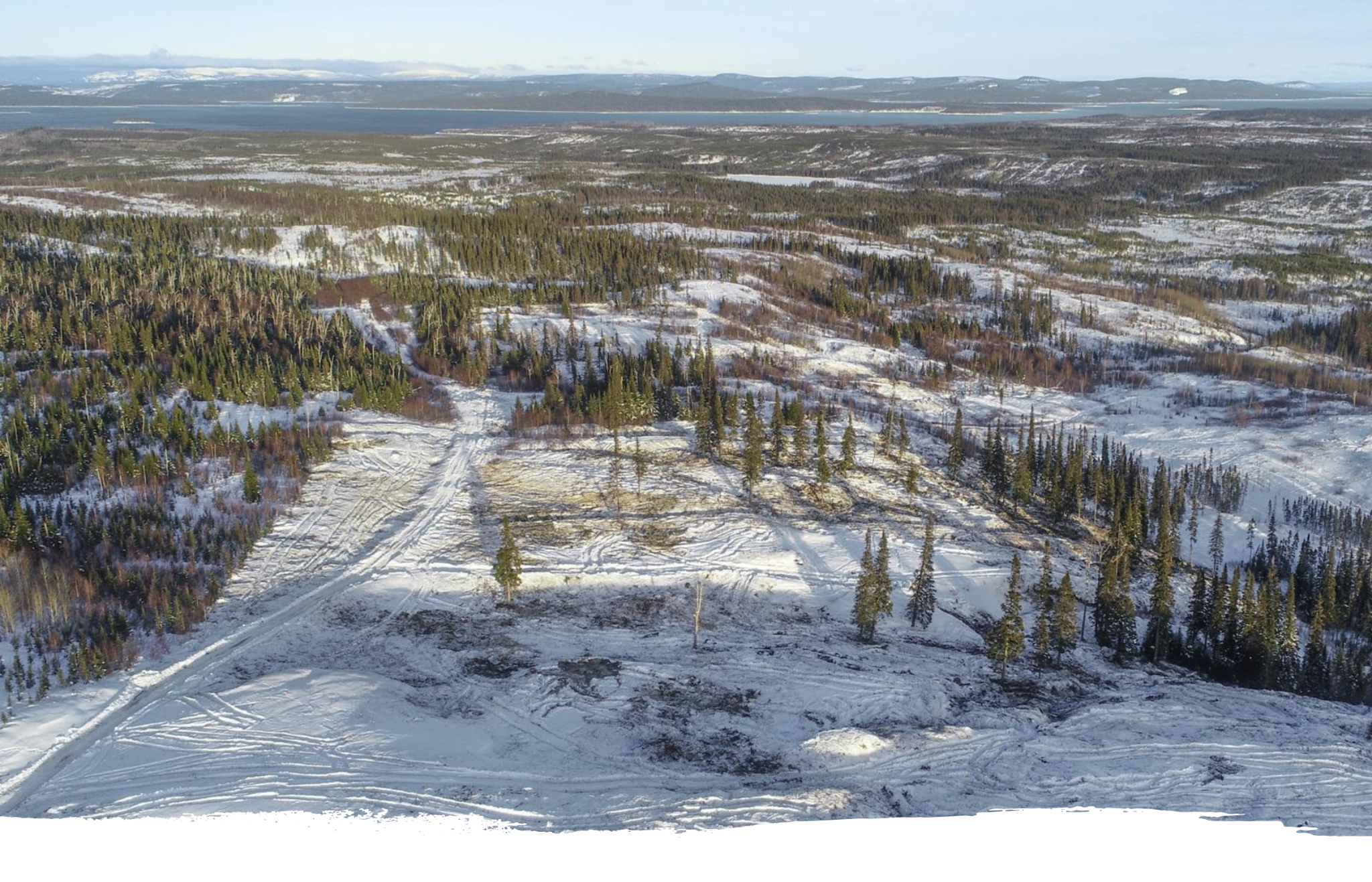

NMG owns a 100% interest in the Matawinie graphite property located in Saint-Michel-des-Saints, 120 km north of Montréal, Quebec.

The Matawinie Mine has demonstrated exceptional potential thanks to its large mineral reserve, our sustainable engineering, a skilled workforce, quality infrastructure, hydroelectricity, and a dynamic regional ecosystem.

Thanks to our partnership with Caterpillar, the Matawinie Mine is about to become the world’s first all-electric open-pit mine.

BÉCANCOUR BATTERY MATERIALS PLANT

NMG is establishing its advanced manufacturing plant in Bécancour, Québec, to produce active anode material. The site is located in an industrial park, AT THE HEART OF QUEBEC’S BATTERY HUB, near a major port on the St. Lawrence River, about 150 km northeast of Montréal.

Solid local infrastructure provides us with a direct supply of chemicals in addition to affordable hydroelectricity, a skilled workforce, and a multi-modal logistics base close to U.S. and European markets.

UATNAN MINING PROJECT

Wholly owned by NMG, the Uatnan Mining Project in Québec’s Côte-Nord region is one of the world’s largest natural graphite projects.

We have launched a ROBUST AND PRAGMATIC DEVELOPMENT process starting with a preliminary economic assessment that has confirmed the project’s technical feasibility and economic viability.

As with our current operations, NMG is committed to promoting best practices in environmental assessment, eco-engineering, collaboration with First Nations, and stakeholder engagement.

OUR PLAYGROUND: QUÉBEC, CA

SET FOR SUCCESS

NMG’s strategic location is the perfect environment for us to develop and grow our integrated operations for booming markets.

World-renowned environmental standards

Stable, pro-business jurisdiction

At the market’s doorstep

R&D powerhouse

Free trade agreements with 40+ countries

Rapidly developing lithium-ion/electric hub

Established mining-sector leadership

Clean, affordable and renewable hydropower

Diverse and skilled workforce

Financial levers to support investment

We also benefit from a shareholder base of government agencies, institutions, anchor customers and strategic investors who are ready to support our development.

LEVERAGING CLEAN HYDROPOWER

Québec has vast water resources from its 500,000 lakes and 4,500 rivers that power the entire province with abundant, green, and affordable energy.

WALKING THE TALK

With graphite playing such an important role in the energy transition, NMG is embracing all-electric operations from the extraction and concentration of ore to the production of advanced materials.

We are set to become the world’s first all-electric open-pit mine—an incredible feat—while bringing to market carbon-neutral products that drive sustainability into the electric vehicle and stationary energy storage value chain.

HELP US BUILD A SUSTAINABLE FUTURE

MAXIMIZING LOCAL BENEFITS

NMG is committed to maximizing the local and regional benefits of our projects through training, employment, and business opportunities with First Nations and local communities.

We manage our procurement through a centralized process that upholds NMG’s environment, quality, and health and safety programs.